ARTICLE

The top five emotional drivers when choosing a financial service provider

The financial services industry is evolving quicker than you can blink an eye. Leading financial institutions are seeking far more from their providers in response than a mere transactional provision of services. They need strategic partners who think along and help them pioneer and navigate change.

At a time when we hand over more responsibility to AI and automation, it’s worth remembering that effective change still manifests itself within the people making decisions and the strength of the relationships they forge.

Recently, Mambu surveyed over 1,500 corporate leaders across Saudi Arabia, Indonesia, Mexico, Australia, and the UK to gain insight into the minds shaping the industry’s future.

The findings, part of the Mambu Insights Series, reveal the core emotional drivers shaping the expectations that decision-makers have from their financial service solution providers to cultivate success.

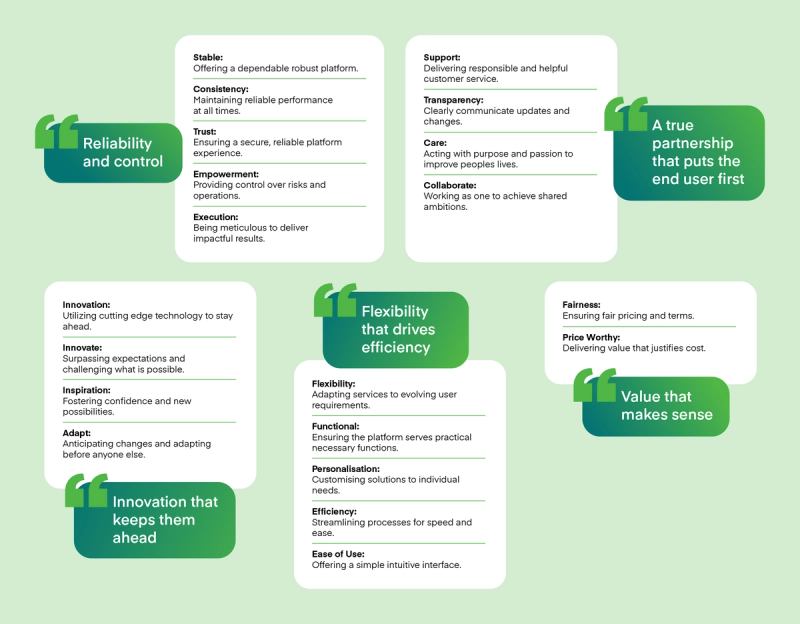

The five core emotional drivers shaping financial services partnerships today

So, what are financial institutions really looking for in a relationship with their providers? What's driving the buying decision-making process? What's the recipe for long-term partnerships that foster loyalty and commitment?

Our research highlights five emotional needs that consistently emerge as the most important when decision-makers assess their ideal partnership.

1. Reliability that puts them in control

At the most fundamental level, businesses need to feel confident that they can rely on their financial platform. That means high performance, top-tier security, and stability they can depend on. These may seem like standard expectations, but the focus here is on the emotional response they evoke.

At the core, we're talking about trust.

A partnership in this context is much like a doubles sport; think tennis. You need to be able to trust your partner to cover their area of the court and remain composed under pressure. When you know you can rely on them, you can focus on controlling and optimising your own game.

2. A true partnership that puts the customers first

Successful organisations aren't just looking for a vendor but a partner. One who focuses on collaboration beyond support tickets. A companion that creates real value by focusing on outcomes that benefit their customers. The mission requires working together on the shared goal of delivering real impact for the people who matter most: customers.

A high level of customer satisfaction correlates to the business's ability to deliver the products and services desired the way they need to be.

3. Innovation that keeps them ahead

The pace of change within the financial industry is not for the faint of heart. Financial institutions are always looking to innovate. Looking to open the doors to fresh ideas, make bold moves and seek new opportunities. It’s the hallmark of any long-term successful organisation. Evolve and adapt. Drive demand and respond to market shifts.

A provider must be equally well-positioned to respond to these needs. That means anticipating industry shifts, inspiring new ideas, and helping businesses stay ahead of the curve. The provider must both bring and enable innovation to the table simultaneously.

4. Flexibility that drives efficiency

One size does not fit all. Decision-makers are looking for solutions that they can tailor to their specific needs. Every institution has its priorities, structures and customer expectations. What they require from a partner is the freedom to act. A flexible solution empowers decision-makers to take action.

A solution must be able to adapt in real-time. Tailored functionality is no longer a nice-to-have but an integral part of a strategy to create a competitive advantage.

5. Value that makes sense

Value that makes cents?! Not entirely. Pricing should always be part of the conversation. However, what decision-makers are looking for is value. How do we measure value? ROI? Sure, but there's a deeper emotional drive to unpack here.

Value is that feeling you get after a great meal at a restaurant that your money was well spent. The cost is something you considered before you came to dine, but the quality and service were so exceptional that cost takes a back seat to the overarching value of the experience.

In tech, the principle remains the same. Solutions must demonstrate and deliver value to earn trust. Be so essential to the way a company operates that your cost is seen as a necessary part of delivering their value.

Delivering on each of these five demands is where the strongest partnerships take root.

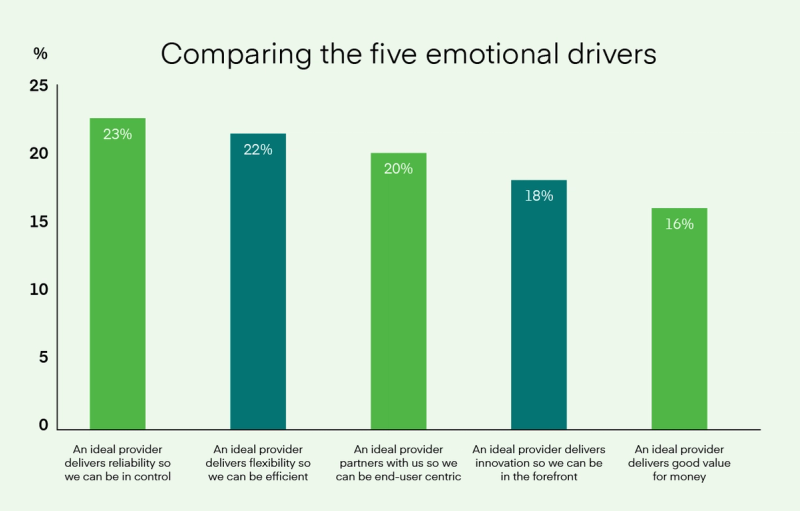

How do these needs stack up?

While all five of these values are essential, our research revealed some interesting nuances in how they're prioritised.

Reliability and flexibility, which enable control and efficiency, are considered foundational. These are the baseline expectations and the non-negotiables. If a provider can't guarantee a stable, secure, and adaptable platform, they're unlikely even to be considered. These needs are, in essence, hygiene factors: crucial to get right, but not enough on their own to win new business.

Further down the priority list is partnership—working hand in hand with customers to co-create meaningful, end-user-centric solutions. This is where value starts to feel real. When a provider brings openness, transparency, and genuine collaboration to the table, it strengthens relationships and lays the foundation for a lasting impact.

Innovation also plays a pivotal role. While not always explicitly demanded, it's often the hidden engine powering better user experiences, differentiation, and future readiness. It enables providers and their customers to challenge the status quo and stay ahead of disruption.

Interestingly, while still a key driver, value for money took a lower standing of priority among the five needs. It is incorrect to assume that it isn't a priority to decision-makers overall. What it signals is that businesses are willing to invest when a solution is aligned with their core strategic goals. As we touched upon earlier, price matters less when the value is unmistakable.

It’s also worth noting that these priorities don’t exist in a vacuum. Wider forces shape them. For instance, heightened geopolitical tensions and growing cyber threats have pushed security and control to the top of the agenda. Perceptions of how well providers are currently delivering on each of these needs are influencing future expectations.

Delivering on what matters most

Here at Mambu we’re keeping our ears on the ground to get inside the minds of our current and potential customers, to create true partnerships and deliver a product that caters to their individual needs. It’s a foundation upon which we continue to build.

As the founders of composable banking, we’ve been leading the vanguard at placing these core needs front and centre of our solutions to provide our customers with control over their offerings.

How does Mambu deliver on these needs?

Scalable infrastructure for growth and control

Our composable, cloud-native platform places no limitations. It’s built to scale, supporting growth across markets and regions while enabling faster launches, smoother compliance, and stronger governance.

Enterprise-grade security that builds trust

Mambu’s architecture is designed with built-in safeguards to protect data and meet evolving regulatory demands.

Innovation that keeps customers ahead

We build with the future in mind. Whether it’s adding new capabilities or enabling integrations with leading fintechs, Mambu focuses on helping financial institutions lead within their markets.

Flexibility that drives efficiency

With a composable approach, every customer can tailor our solutions to their specific needs. From product creation to user experience, our platform is built to be agile.

Simplicity that enhances value

True value enables value. We focus on creating intuitive experiences that support and drive our customer’s value toward their own customers.

The bottom line

The top emotional drivers uncovered in our research — reliability, partnership, innovation, flexibility, and value — provide insight into the real-world criteria that decision-makers use to choose which provider they want to partner with to build, scale, and grow.

One theme remains a constant throughout them all. Trust.

Trust is the emotional currency of any successful partnership throughout life, and those within financial services are no exception. The strongest and healthiest partnerships, after all, are built on trust, security, and a commitment towards mutual value and evolution.

These are the relationships that withstand the test of time. At Mambu, we’re building relationships.

Curious how we can help you deliver more?

Explore our solutions and see how Mambu supports financial institutions to grow, adapt, and lead.