ARTICLE

SEPA direct participation in 2025: key regulations and impact on financial institutions

1 July 2025

As of 2025, a number of regulatory and policy changes have reshaped the landscape of participation in SEPA schemes.

The most notable shift: payment institutions and electronic money institutions (PIs and EMIs) can now pursue direct participation in SEPA payment systems – a possibility previously reserved solely for credit institutions.

This change has led to a cascade of updates, which are collectively not only redefining technical and operational standards, but also raising new strategic and competitive considerations for all types of financial institutions.

1. A reminder on SEPA Participation models

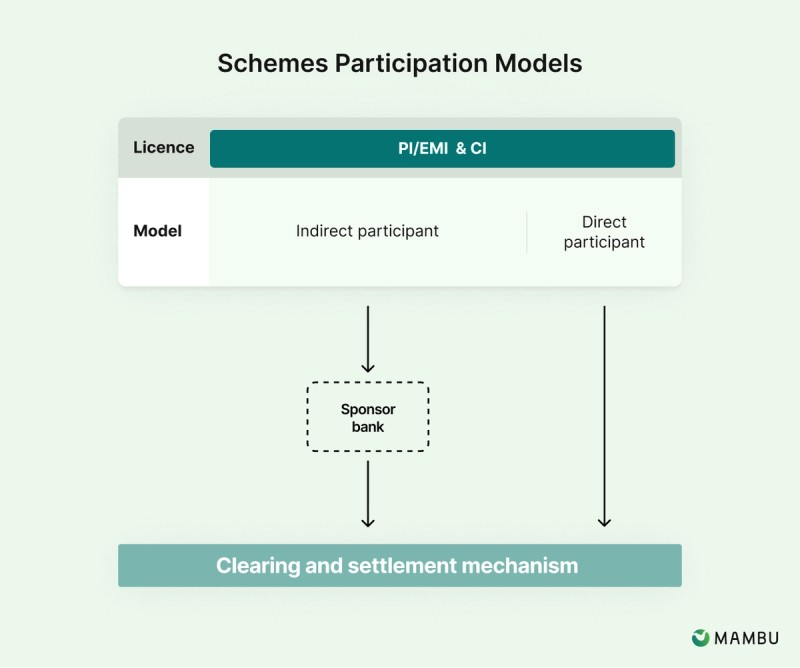

There are two models for accessing SEPA schemes: direct and indirect participation.

- Direct participants connect directly to a clearing and settlement mechanism (CSM) and typically hold a settlement account with a central bank.

- Indirect participants partner with a “sponsor” bank, a credit institution which is itself a direct participant and provides access to the SEPA schemes while handling settlement on their behalf.

Historically, the indirect model was the only available option for PIs and EMIs, because:

- CSMs simply did not allow non-bank payment service providers (PSPs) to connect directly

- The European Central Bank (ECB) restricted access to accounts to credit institutions

As a result, there were no avenues for PIs and EMIs to become direct SEPA participants, as this was an option reserved for credit institutions. But that has now changed.

2. A timeline of regulatory changes impacting direct SEPA access

PSD2 setting the stage for PIs and EMIs

Adopted in 2015, the second Payment Services Directive (PSD2) established the legal framework for PIs and EMIs within the EU, but kept interbank settlement access exclusive to credit institutions.

The yet-to-be-published PSD3 was expected to address this gap, but the mandate for direct access was eventually implemented through the Instant Payments Regulation (IPR), which was adopted by the European Parliament and Council in March 2024.

IPR paving the way for direct SEPA access to PIs / EMIs

The IPR came with the goal to modernise the landscape of instant payments, and ensure new operational standards and enhance end-customer experiences. The changes brought it were significant:

- An amendment to the Settlement Finality Directive (SFD) explicitly adding PIs and EMIs to the list of institutions that can get direct access to payment systems. For context, the SFD was originally introduced in 1998, with the aim of reducing systemic risk from the insolvency of participants in payment and securities settlement systems.

- Imposed obligations on all Eurozone PIs and EMIs to receive and send SEPA Instant Credit Transfers (SCT Inst) by 9 April 2027, with pricing parity to regular credit transfers required by 9 January 2025. For PIs and EMIs outside the Eurozone, the compliance deadline for receiving is also 9 April 2027, while the deadline for sending is 9 July 2027 and pricing parity must be achieved by 9 January 2027.

CSMs followed suit. Systems such as EBA CLEARING’s RT1/STEP2 and the Eurosystem’s TIPS, as well as local mechanisms, have amended their rulebooks to permit non-bank entities to connect as direct participants. Of course, this remains contingent on adherence to technical standards (e.g. ISO 20022), central bank settlement access – which is accomplished directly or indirectly via a settlement partner bank – and safeguarding requirements.

Eurosystem setting the policies for PIs and EMIs to access payment systems and central bank accounts

Following the adoption of the IPR, in July 2024 the Eurosystem published its Policy on access by non-bank payment service providers to central bank-operated payment systems and to central bank accounts. By detailing the operational framework for non-bank access, it stipulated the following:

A. Access to TARGET would be granted to authorised non-bank PSPs that meet the operational and technical requirements already applicable to credit institutions

These requirements are listed in TARGET’s official guidelines. Just like credit institutions, PIs and EMIs seeking to become direct participants must also follow the CSM’s technical and operational rules.

B. PIs and EMIs will not be able to safeguard customer funds at central banks, but only with licensed credit institutions.

3. How do these changes affect you, what possibilities do they open?

Credit institutions

While credit institutions retain full access rights to SEPA schemes and central bank accounts, the environment is shifting around them, with regulatory updates lowering the barrier to entry for non-bank PSPs.

These changes may signal new competition from PIs / EMIs, potentially reducing the demand for indirect access services in the long run.

PIs and EMIs

With direct access to SEPA systems now within reach, the IPR in place, but systems like CENTROlink phasing out their safeguarding support, the implications here are more profound.

PIs and EMIs have a set of new opportunities unlocked, that come with great costs, responsibility and operational complexity nevertheless.

A. Strategic Control

Direct participant PIs / EMIs are no longer bound by a sponsor bank’s risk policy or onboarding restrictions, allowing them to serve customer profiles that could otherwise be excluded. They also gain independence from their sponsor's operational timelines, such as cut-off times, batching schedules, or maintenance windows, which enables tighter control over their customer experience and SLAs.

What is more, direct participants can integrate new schemes as soon as they launch on CSMs, without waiting for sponsor support.

However, this independence is not absolute, as PIs and EMIs still depend on credit institutions for safeguarding. What is more, establishing relationships with CSMs and relevant institutions, as fruitful as they may turn out to be, can prove to be more of an operational burden than a competitive advantage in terms of marginal impact. In fact, it is considered part of the complexity and load that sponsor banks relieve indirect participants from.

B. Differentiation

By becoming direct participants, financial institutions could potentially act as “sponsor banks” and offer indirect participation to other PSPs. Since they must hold a settlement account with a central bank (either the ECB or a national EU central bank), they are able to settle transactions on their own behalf and, potentially, their sponsored PSPs. That said, these accounts are strictly settlement-only, with limitations on balances and no access to intraday credit, reserve holdings, or safeguarding functionalities. Client safeguarding must be handled via third-party credit institutions. While it may be technically feasible for a direct participant to hold safeguarding accounts for others, it remains unclear whether this is permitted or supported in a regulatory context.

There is also no clear precedent or guidance yet on how a PI or EMI acting as a direct participant could offer the same level of sponsorship services as a credit institution. While it appears possible in principle, this has not been officially confirmed.

Should this opportunity be clarified or streamlined through regulation, it could unlock new avenues for growth by generating revenue from new commercial activities.

4. Summary

Over the past decade, a cascade of regulatory changes has reshaped the landscape of SEPA participation. These are:

- The PSD2 establishing the foundation for PIs and EMIs in 2015

- The IPR unlocking direct SEPA access for PIs / EMIs in March 2024, thus removing the exclusivity from credit institutions

- The Eurosystem setting the rules of direct access for PIs and EMIs in July 2024

- The ECB officially forbidding safeguarding at central banks while formalising liquidity requirements for non-bank direct participants in January 2025

- CSMs updating their rulebooks to support non-bank access, and CENTROlink ceasing safeguarding accounts for PIs and EMIs from April 2025

For fast growing PIs and EMIs, the new regulatory framework offers an opportunity to reduce costs, gain strategic control, and build competitive advantage. That is if they are willing and able to take on the financial risk and complexity of direct access.

Credit institutions, meanwhile, will need to reassess their role in this shifting ecosystem, as the lines between banks and non-bank PSPs continue to blur. Direct participation remains a complex and capital-intensive process that few institutions can tackle alone – sponsor banks should not underestimate their role. In fact, one key takeaway for them is that they should better market all the complexity they abstract for indirect participants, as they are much more than regulatory-imposed gatekeepers of the scheme.