Simplifying everyday finances for Swedes with Mambu

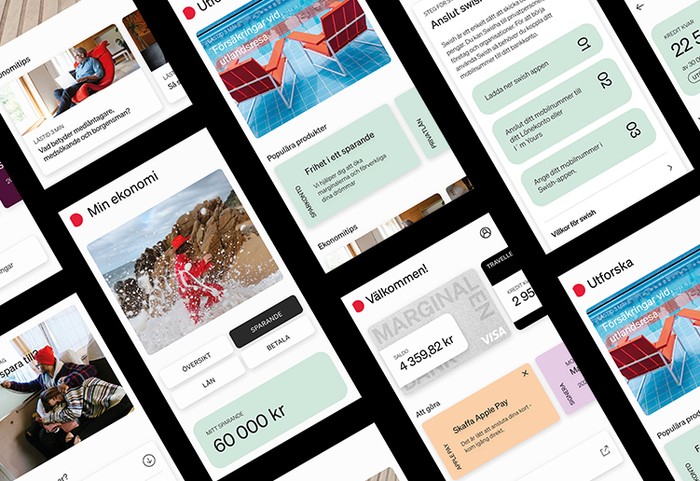

Marginalen Bank, a Stockholm-based digital bank founded in 2010 successfully migrated from its legacy core to Mambu achieving rapid time to market for its new consumer and business deposits.

- customers and growing

- SEK in public deposits managed

- months to complete full migration

MARGINALEN BANK

About the customer

Founded in 2010 following the acquisition of Citibank’s Swedish consumer bank, Marginalen Bank believes that as many people as possible should have access to simple and clear financial products.

The bank offers some of the market's best savings accounts, cards, insurance and various types of financing to people and companies. With the ambition to create greater margins in the customer's everyday life, Marginalen Bank is involved and fulfils goals and dreams.

The Marginalen Bank group has more than 300 employees spread over offices in Stockholm, Skellefteå and Hudiksvall and is owned by the parent company Marginalen AB. The bank is certified according to ISO 9001:2015 and operates under the supervision of the Financial Supervisory Authority.

The challenge

The need for modernisation

Facing an end-of-life legacy core system that hindered innovation, Marginalen Bank recognised the urgent need for a strong, scalable infrastructure.

Driven by a commitment to meet changing customer demands and rising regulatory pressures – alongside their mission to provide accessible financial products to all – the bank embarked on a modernisation journey.

They required a flexible platform that would enable rapid product development, efficient scalability, and consistent seamless financial experience for their customers.

“Our goal has always been to simplify our customers’ everyday financial lives, and to do so, we need a strong, scalable infrastructure. Mambu’s composable banking approach perfectly complements Marginalen’s technology strategy. We’ve been able to seamlessly migrate to the modern core and future-proof our technology.”

- Bo Andersson, Chief Information Officer at Marginalen Bank

The solution

A composable core banking platform on the cloud

Marginalen Bank selected Mambu's cloud-native banking platform as the foundation for its core transformation and successfully migrated to it in just 13 months, in partnership with system integrator Avenga, and underpinned by Microsoft Azure Cloud.

The project involved decommissioning the bank's legacy core banking system and establishing a fully integrated, cloud-first architecture including a comprehensive data migration and integration across the bank's ecosystem (Data warehousing, microservices, and local third-party providers).

"Our team ensured a fully compliant, zero-downtime transition by orchestrating data migration, system decommissioning, and integration of core banking services, microservices, and third-party providers. This transformation not only enhances Marginalen’s operational efficiency and scalability but also positions them to rapidly introduce new financial products in response to market demands."

- Peter Stros, SVP Banking and Financial Services

“The Nordic banking sector is undergoing a significant transformation, with financial institutions modernising their infrastructures to stay competitive and meet evolving customer expectations. Together with Mambu and Avenga, we are helping banks like Marginalen accelerate their cloud transformation, enabling them to scale efficiently while maintaining the region’s stringent security and compliance standards.”

- Ingmar Boon, Digital Natives EMEA Lead

The impact

From legacy to leadership with agility and scale

The successful cloud migration allowed Marginalen Bank to modernise its consumer and business deposit offerings. Replacing legacy systems significantly improved its agility, scalability, and cost-efficiency.

The new cloud-native architecture now enables the bank to rapidly launch financial products, deliver modern banking experiences, and maintain full compliance with Nordic financial regulations.

This strategic move better positions Marginalen Bank for future growth and opportunities.

Build the future of banking.

Mambu helps 260+ banks, lenders and fintechs across 65 countries make more possible. Modernise your core, scale deposits, lending and payments and deliver the modern financial experiences your customers expect.